The Tax Reform for Acceleration & Inclusion Law or TRAIN Law

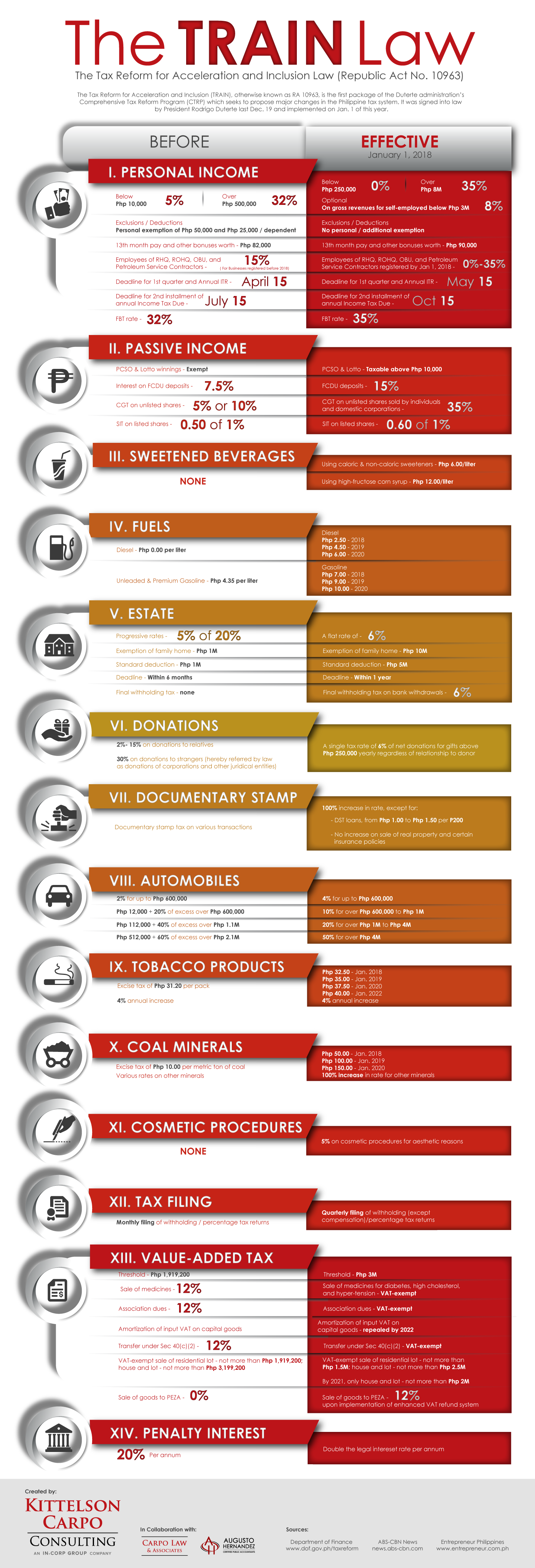

R.A. 10963, more popularly known as the Tax Reform for Acceleration and Inclusion or TRAIN Law, is the first package implemented from the Comprehensive Tax Reform Program (CTRP) of the Duterte Administration, that aims to make major changes in the tax system in the Philippines. On December 19,2017, President Rodrigo Duterte signed it into law and became effective on January 1, 2018 .

Here are some of the aspects affected by this law:

- Personal Income

- Passive Income

- Sweetened Beverages

- Fuels

- Estate

- Donations

- Documentary Stamp

- Automobiles

- Tobacco Products

- Coal Minerals

- Cosmetic Procedures

- Tax Filing

- Value-Added Tax

- Penalty Interest