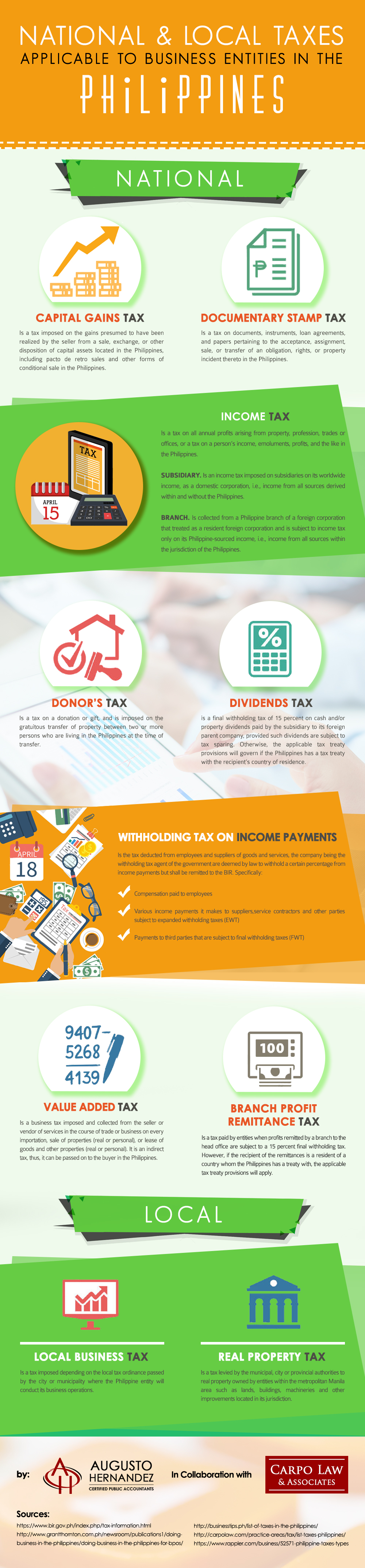

National and Local Taxes applicable to business entities in the Philippines

Philippine taxes cover national and local taxes. National taxes are imposed and collected by the national government through the Bureau of Internal Revenue (BIR) while local taxes are collected by local government units.

Most of the taxes that apply to your business are administered by the national government, which are as follows:

• capital gains tax;

• income tax;

• dividends tax;

• documentary stamp tax;

• withholding tax on income payments;

• value added tax;

• donor’s tax; and

• branch profit remittance tax.

Local government units, on the other hand, are subject to limitations in imposing taxes to business entities. The exercise of local government taxing power for businesses are limited by the Constitution to the following:

• local business tax; and

• real property tax.