Bullet TRAIN for Growth

Written by: Atty. Amanda Carpo

Tax Reform is high on the Duterte Administration’s agenda. In a near unanimous majority, and after the consolidation of 55 separate bills, House Bill 5636, or the Tax Reform for Acceleration and Inclusion or “TRAIN” was approved by Congress on May 15. House Bill 5636 is not the law, yet. At this stage, it is proposed legislation, but with the approval of 246 members of Congress (out of 256 voting), it is a TRAIN with wings.

Process

Presently, the bill is being deliberated in the Senate where it will go through the regular legislative process. The Senate may approve it or completely substitute, amend or overhaul it. If the House Bill and the Senate version are different, a bi-cameral conference committee will be formed to harmonize the bill.

For the bill to become a law, it must first be approved by Congress, that is, both the House of Representatives and the Senate. Second, the President must approve the bill. This occurs once the bill is harmonized, submitted to the President and the President signs it into a law, or does not act on it, in which case it automatically becomes a law within 30 days after its receipt. The President may also veto the bill in its entirety. A line item veto by the President is allowed in the case of revenue bills under Article VI Section 27(2) of the Philippine Constitution as long as the veto does not affect the items to which the President does not object. The veto can be overridden by a 2/3 vote of Congress. Given the voting on the bill, possibility of its passage in its present form or otherwise, appears imminent.

A Sampler of Tax Policy Trends Around the World

The Bullet TRAIN is meant to take the Philippines on a fast track to growth, fund the infrastructure program of the Administration, simplify tax administration, enhance the progressivity of the tax system, increase the disposable income of Filipinos, increase economic activity, and address income inequality. The courageous goals of the TRAIN are to achieve 7% GDP growth for a generation, reduce poverty, and support better infrastructure, health, education and social protection for all Filipinos. It lowers the tax rate for those earning P250,000 or less to 0%, increases the top tax rate, and generates revenue by widening the VAT base, increasing excise taxes, and improving collection through the use of electronic data. How does our tax policy compare to others’?

In India, the government’s tax policy focus has centered on encouraging foreign investment and growth through reducing the corporate income tax rate and strengthening international tax rules to avoid profit shifting and erosion of the tax base. In the US, President Trump has famously stated: “The US is open for business”. His administration is focused on making the US more competitive in the global economy by lowering business and individual tax rates for domestic businesses, introducing decreased regulation for US businesses, simplifying the behemoth U.S. Tax Code, and preserving US domestic manufacturing jobs. The Republicans, who now enjoy the majority in both houses, have a distinct opportunity to advance their tax reform agenda. In China, the State Administration of Taxation introduced a 5 year plan in 2016 which includes B2V reform (business tax to VAT), tax incentives to boost innovation and High/New Technology Enterprises, extension and expansion of Technology Advanced Service Enterprises tax relief, relaxed procedures for Software and Integrated Circuit Enterprises, and the poetic Golden Tax System/ Thousand Groups Project aimed at tackling tax evasion and avoidance through big data analytics and collection.

Two Goals: Revenue Generation and Competitiveness

If there is a common thread to these broad statements on tax policy and tax reform, it is that they boil down not only to how these nations intend to generate revenue to fuel infrastructure spending and the business of government but also how they can make themselves more competitive. Broadening the base, lowering/increasing the rates, taxing one industry over another, granting incentives, improving administration and collection, preventing erosion, and incorporating big data, are all part of a recipe to achieve balance the budget and grow GDP. The question is, will these reforms achieve their goals?

TRAIN and IT BPO

The particular formula proposed by Congress has significant impact the IT and BPO industry, which are generally export enterprises. The current bill preserves VAT zero rating on sales of goods and services to export-oriented industries considered in “export sales” or constructive exports under the Omnibus Investment Code, but only until an enhanced VAT refund system is established and implemented, which gives the taxpayer a refund or denial of their application within 90 days from filing. Currently, the VAT refund process involves an administrative claim with BIR, being subject to audit, filing a petition in the Court of Tax Appeals- more often than not, paying the requisite filing fees, and a long wait, even if successful. Shortening the period for refund to 90 days is welcome, but zero rating “exports sales” or rather, indirect exports is better and eases the administrative burden for both BIR and Taxpayer.

Increasing the excise tax on petroleum products by 30-40% will increase the cost of all goods and services that rely on these commodities. Transportation, power, logistics, and production costs to name a few, will go up, with costs likely to be passed to businesses and consumers. The excise tax seeks to change consumer behavior, presumably to make us less reliant on petroleum and petroleum-based products, but sustainable alternative products and consumption patterns are not yet ready.

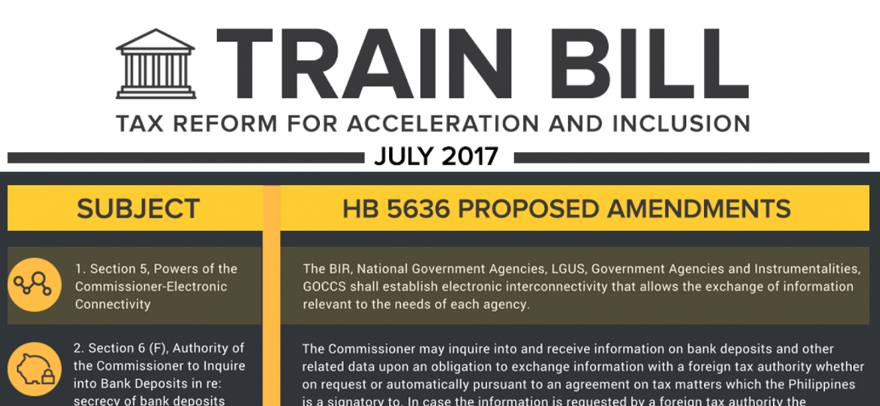

The proposed law mandates electronic interconnectivity of taxpayer information, requires simultaneous issuance and reporting of receipts to BIR through electronic point of sale systems (whose cost must be borne by the taxpayer), and opens the door to the automatic exchange of tax and financial information. Congress is following a global trend toward Big Data. While we will make strides toward aggregating information and automation, there are privacy concerns that need to be addressed. In addition, supporting these newly mandated systems will require infrastructure that is presently lacking.

A 90 day VAT refund system, electronic interconnectivity, and higher excise taxes while ideal, requires maximum efficiency from the BIR and a level of trust and transparency between the taxpayer and the BIR and the government that is nearly utopian. If the bill became law tomorrow, the adjustment for taxpayers would be painful. The drastic changes will require adaptation.

The Future

An attractive investment environment is one that is predictable, which is why the IT BPO could use some assurance that it will be business as usual. The data is there to prove that the IT-BPO industry has increased exports, employment, foreign direct investment, and stimulated the local economy, whether that is real estate, retail, or consumer spending. For the industries’ clients, the investments made in the Philippines are long term. Maintaining the Philippines’ competitive advantage and managing costs will be a challenge as the tax landscape changes.

This article was based on the discussion of Atty. Amanda Carpo during the IT & Business Process Association of the Philippines'(IBPAP) Executive’s Circle event hosted by KMC Solutions at KMC Skydeck in BGC.