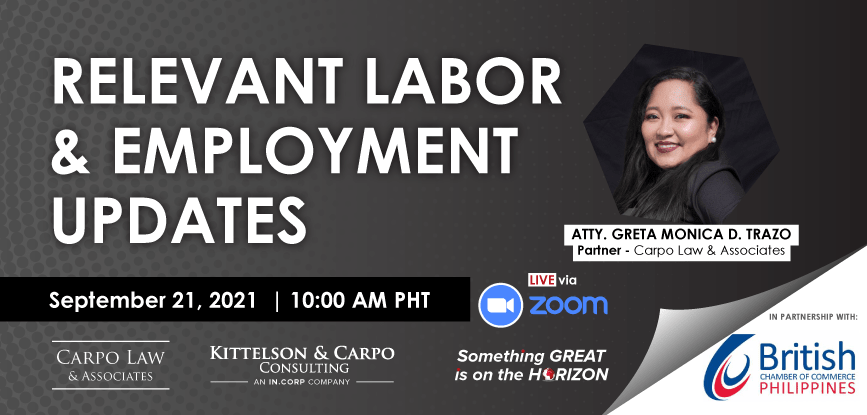

Carpo Law & Associates and Kittelson & Carpo Consulting, in partnership with the British Chamber of Commerce, bring you “Relevant Labor and Employment Updates”. This webinar will cover discussions on substantial issuances of the Department of Labor and Employment (DOLE), updates on vaccination, duties of employer, and Compensation and Benefits of Employees.

Events

Carpo Law & Associates, in partnership with Kittelson & Carpo Consulting, brings you “IN-DEPTH DISCUSSION SERIES: Tax and Labor Updates During COVID-19”. This webinar will cover discussions on work preservation under economic difficulty and national emergency. It will also discuss BIR regulations under the newly-enacted Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act.

Carpo Law & Associates, in partnership with Kittelson & Carpo Consulting and AHC Certified Public Accountants, took part in the recently concluded event titled “In-Depth Discussion Series: Tax Compliance, Annualization, Investigation and Remedies, and the Future of CITIRA” held at the KMC, Net Quad, Bonifacio Global City, Taguig City, last November 15.

Atty. Rhondee Dumlao, Junior Partner of Carpo Law & Associates, took part as a speaker in the “Business Breakfast: Tax Investigation and Taxpayers’ Defenses”, hosted by the British Chamber of Commerce Philippines together with Kittelson & Carpo Consulting last October 17, 2019

Atty. Monina “Monette” Velasco, Senior Associate Lawyer of Carpo Law & Associates, provided her expertise on Philippine Tax during the “MMM: Get Your Company Ready For BIR Assessmets”, hosted by the Australian-New Zealand Chamber of Commerce Philippines (ANZCHAM) in partnership with Austrade

Atty. Greta Monica Trazo and Ms. Mary Jane Jong-Luarez took part as speakers in the “In-Depth Discussion Series: Expanded Maternity Leave Law and Payroll Computation”, hosted by Kittelson & Carpo Consulting in partnership with Carpo Law & Associates.

Atty. Greta Monica Trazo discussed the relevant details in the recently passed Expanded Maternity Leave Law in the event, “LABOR BRIEFING: The Present and Future of Work” hosted by the British Chamber of Commerce Philippines together with Kittelson & Carpo Consulting as one of the main partners, held on May 16 at the Makati Diamond Residences.

Atty. Rhondee Dumlao, CPA, Tax Lawyer, and Senior Associate at Carpo Law & Associates, took part as one of the speakers in the event, “Essentials of Corporate Taxation, HR Management and Payroll Processing in the Philippines” last April 25 at the Kittelson & Carpo Community Area, Marajo Tower, BGC, Taguig City.

Atty. Diana Lyn Bello-Castillo took part in the Business Breakfast held last March 29 at Kittelson & Carpo Community Area, 8/F Marajo Tower, Bonifacio Global City, Taguig.

Carpo Law & Associates, in partnership with the Filipino International Franchise Association (FIFA) took part in the FIFA Annual Membership Meeting 2019. This covers discussions on the features of TRAIN Law and the Tax Amnesty Act, as well as the tax updates that could affect doing business in the Philippines.